We have spoken before on what you should look for when deciding on a virtual data room. But before you get to that stage of a deal, whether you’re in M&A, Corporate Finance, Real Estate, Legal, or Capital Raising, how do you ensure your most sensitive documents and data are in order?

Vendor due diligence (VDD) is a term used for sell-side due diligence, (as opposed to buy-side due diligence) and is an independent review of a company before it is put up for sale. This process has grown in popularity in recent years as sellers have realised they learn a lot about their own company or asset from the VDD process.

This process ensures the company is valued appropriately and identifies any red flags before a buyer would see them. It is through vendor due diligence that a company saves time and resources for all parties concerned, and, if conducted effectively, can often help with increasing the sales price for the company or asset.

When Should I Start Conducting My Vendor Due Diligence?

It’s crucial to conduct your vendor due diligence as soon as you know you’re looking to sell something as part of an M&A, Real Estate, or Capital Raising process. Highlighting red flags early in the process can save time because the seller can remedy any issues before the sale has commenced. Sellers can ensure all necessary documents are structured and indexed logically, their content reviewed and sensitive information redacted. You will want those who conducted the vendor due diligence to be involved in the sales process. Their in-depth knowledge of the documents makes them ready for any questions the buyers and bidders should have, so expect them to be involved in any pitches or presentations involving interested buyers.

And What Should We Look Out For When Conducting Vendor Due Diligence?

Each company will have bespoke contracts and data points that it should consider – industry or sector could influence this. But that is not to say there aren’t ground rules everyone looking to conduct vendor due diligence should follow.

Before reading the below, always follow these 3 tips:

- Your documentation is categorised and indexed in a logical ‘buyer-friendly- way, ready for data room upload.

- You’ve thoroughly reviewed said documentation and done all you can to identify potential red flags

- You’ve securely redacted any information that could compromise regulations or compliance (such as GDPR) when sharing it with interested buyers.

A. Company Information

This may sound obvious, but oversights do occur. You will want to make sure the documents are legitimate and up-to-date. Local laws and regulations can inhibit certain operations, and you will want to make sure these are reviewed before you invite in bidders.

B. Risk Mitigation

Data breaches from third parties rank among the most expensive cyber attacks so you will want to ensure you’ve included the company’s cyber risks within your vendor due diligence. How vulnerable is your company? How have you overcome these measures? What steps are in place to mitigate data breaches?

You would also need to review your company’s reputation. Questions from the buy-side may include how you addressed any negative reviews, if there are any litigations bidders should be made aware of etc.

Issues with your company’s operations. What is employee turnover? Any pending employee lawsuits that potential buyers should be made aware of? Code of conduct?

While these may seem counterproductive, the opposite is true. By not addressing these red flags early, and waiting for the buyer, who will do their due diligence, to raise them would put your company on the back foot in negotiations.

C. Financial Documents

It is clear that understanding the balance sheets, the intellectual property, and any major assets are most important to the buyer-side of the process, but that doesn’t mean you can overlook this.

Much of this article has been focused on whether your company is involved. However, we know that third parties are involved to help a company conduct its vendor due diligence, and you will want to work with a financially solvent client. By looking at their financial records ahead of the deal will ensure that yours, the buyers, and the seller’s interests are aligned.

How Can Imprima Help?

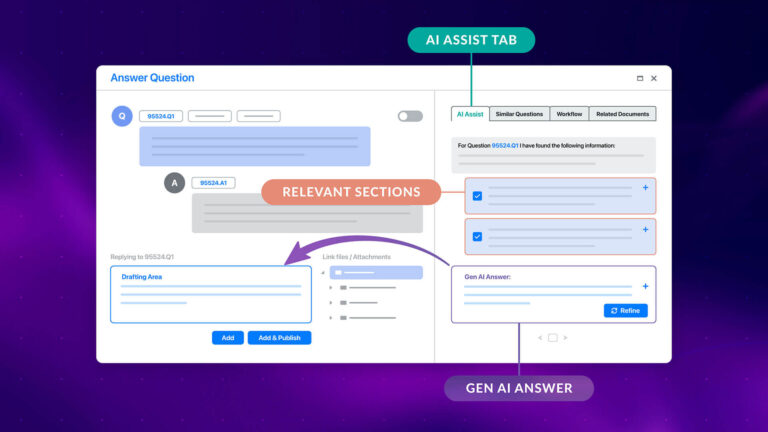

Imprima is the only due diligence platform to cater for vendor due diligence, data room preparation, virtual data rooms, and post-merger integration. Our solutions encompass the entire M&A lifecycle and maximise productivity whilst reducing the complexity of transactions. If you’re interested in Vendor Due Diligence, you’ll want to hear more about the following products: Smart Review, Smart Redaction, and Smart Index.

Our technology helps you automatically index and structure your documentation, spot red flags and redact sensitive information.

Learn more about Imprima AI and schedule a demo today.

Find out more about Imprima’s AI-driven software for Due Diligence: