VDR Platform for Capital Raising

Raising capital for your company can be made easier – done in less time and with greater insight as what investment opportunities are on offer. Let us help you to raise capital faster with a virtual data room.

Why choose Imprima VDR?

Why leading M&A dealmakers choose Imprima VDR to manage their raising capital project

Virtual Data Room designed to accelerate complex transactions:

- Access documents up to 15x faster with optimized storage architecture.

- Scales automatically with parallel processing to support AI-assisted workflows instantly.

Advanced AI tools for document indexing, review, redaction, translation, and Q&A.

- Works for any document in any language or jurisdiction.

- Automated Redaction for instant GDPR compliance.

Dedicated project managers with 10+ years’ experience, supporting your transaction from start to close.

- Proven customer satisfaction: 5-star customer service rating from Imprima VDR users.

- Always available: 24/7 support desk with assistance in your local language.

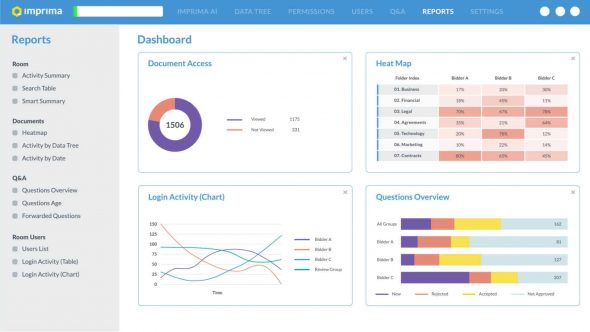

Actively monitor user engagement and data room activity in real-time:

- Live dashboards: Use pre-configured or custom reports to track activity.

- Bidder insight: Monitor bidder engagement and interest using intuitive heat-maps.

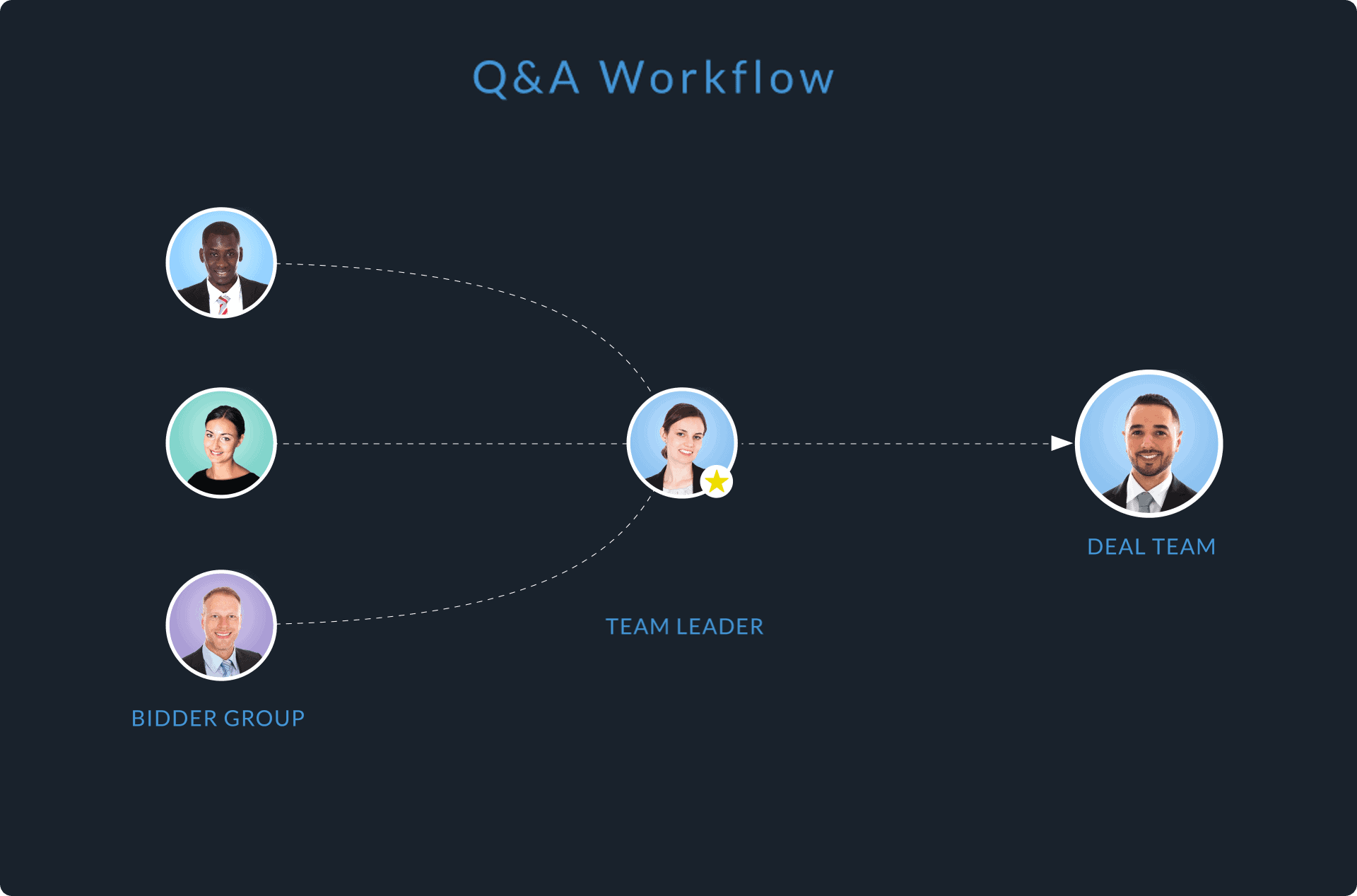

Purpose-built Q&A area designed to manage high volumes of questions efficiently.

- Workflow automation via bespoke tags and auto-forwarding.

- Smart Q&A (AI-assisted) – automatically generate answers and spot previously similar questions.

Security and compliance built into every part of the Imprima Virtual Data Room.

- ISO 27001:2022 certified and GDPR compliant.

- EU-based data hosting.

It’s a very easy platform that allows the control of information by both parties and has a very easy Q&A process that is important in a Due Diligence Stage.

Your security credentials and track-record gave us the peace of mind that our information was safe and the system was always available, meaning we did not have to worry about delays on the deal.

The excellent data room service was essential to our successful transaction. We will definitely select Imprima as our data room provider in the future.

We really appreciate your flexibility and high-quality service throughout the transaction, especially your quick responses and turnarounds to our requests.

The Imprima VDR platform was always quick and reliable for us and our clients. The team’s ‘hands on’ and client-oriented approach allowed us to lean on them throughout the entire project. The Imprima Service Team responded quickly and precisely at all times and we at Unicredit really appreciated this.”

We used Imprima’s virtual data room service for a privatisation process over a period of almost 12 months. The system was easy to use and we didn’t need any special training to set it up. The management of the documents, the access levels and the questions sent to us from the bidders electronically was straightforward.

Capital Raising VDR You Can Trust

Why should you use VDR when raising capital?

Only with informed insight, can you make the best investment decision to generate funds for your company. Yet to manage the corporate finance with tight deadlines, with multiple investors to negotiate with and stringent disclosure requirements, mistakes can be made, and business funding opportunities can easily be missed.

Having up-to-date information about your business and the time to respond to all investor enquiries is crucial. Imprima’s Virtual Data Rooms provides a central capital-raising platform for you to manage the capital raising process, allowing you to easily exchange company information, and share and control large volumes of data among investors and prospects.

Using Data Room Q&A during capital raising

The Q&A functionality within Imprima VDR gives your deal manager an easy way to respond to incoming enquiries relating to the opportunity, improving the efficiency and due diligence of the entire business investment and capital raising process.

We are the only virtual data room provider to help you facilitate the most efficient communications when raising funding with our Advanced Q&A tool – allowing angel investors and private equity parties to quickly ask and validate questions about your business.

All Q&A messages and collaborative activities are tracked in your highly secure and ISO accredited Virtual Data Room.

Key Features for Raising Capital

Advanced Q&A

Fast & efficient collaboration in a single secure Q&A environment

Real-Time Reporting

Speed up your analysis and quickly assess what bidders are interested in

Powerful AI Tools

AI-powered VDR Index, Contract Review and Contract Summaries

Automated Redaction

Automatically protect confidential information to comply with latest regulations

User Access Control

Granular permissions on users' data access & full document protection

Secure Excel Viewer

Access MS Excel documents online through a native-like experience

Granular Permissions

Control your documents on a group or user level, down to document level

VDR Branding

Market your firm with a branded VDR while marketing your real estate portfolio

Pre-VDR Services

We help you source, structure, and corroborate all your data and archives

API

Manage, download & upload documents straight from your CRM system to your VDR

Full Audit Trail

100% auditable trail for compliance on all user and administrator actions

Bulk Actions

Asset managers can perform large scale changes quickly

Customer Success Stories

Some of the deals hosted on Imprima Virtual Data Room for raising capital

- Pharma, Medical & Biotech

Hong Kong-based investment firm HSG has entered into a definitive agreement to acquire the Avelox (moxifloxacin) antibiotics business from Bayer, for a deal value of roughly €160m – €260m. The acquisition includes the Avelox brand, intellectual property and commercial rights across all markets worldwide. Imprima Virtual Data Room was used to for the transaction.

- Consumer

Pottery manufacturer Royal Delft, the maker of Delftware, is acquiring cheeseware manufacturer Boska. The acquisition is valued at €10.5 million, the two Dutch companies announced in a statement. Imprima Virtual Data Room was used for the transaction.

- Energy

TotalEnergies has sold its subsidiary WinWatt, energy management software and services provider, to Reno energy. Imprima’s Virtual Data Room was used for the deal.

Learn more about Imprima's Due Diligence Platform

FAQ

Setting permission levels within your virtual data room across all folders and documents means multiple investment parties can have access to all relevant venture capital information through the same repository, giving you complete control and peace of mind during the capital raising process.

To ensure you’re compliant, we offer Full Traceability with your Virtual Data Room.

Our improved business finance functionality will generate accurate document and activity reports in real time.

We also provide your venture capital team with the ability to create detailed and customised in-depth reports – get insight into your investment transaction with enriched and invaluable oversight of the activity of each user group.

Once the investment or corporate finance has been agreed – Imprima VDR provides a detailed and documented record of the investment deal.

On completion of the deal, you will receive an encrypted DVD with the audited contents of your VDR under secure courier.