Virtual Data Rooms for Investment Banking and Financial Services

Imprima VDR is a trusted partner and advisor for some of the world’s largest transactions in this sector, including mergers and acquisitions, raising capital, recapitalising and managing non-performing loans (NPLs).

Key Features and Benefits

Why leading M&A professionals choose Imprima Due Diligence platform to manage their investment banking projects.

Market-leading service provider

Imprima has been a market-leading service provider of Virtual Data Rooms for Financial Services for over a decade. Some notable transactions have included:

- Lloyd’s acquisition of HBOS – largest-ever bank acquisition / 4 billion rights issue

- RBS acquisition of ABN AMRO – largest bank acquisition at the time

- EFG Eurobank Greece privatisation process

All-inclusive Data Room service

The banking and financial services industry often works under extreme time pressure, across global time zones. We understand that during a deal process, time is of the essence and that you require an all-inclusive VDR service that is available 24/7.

Secure information sharing around compliance and corporate risk is essential to meet your objectives and by using Imprima VDR, we can ensure information is safeguarded and regulatory and business risk is greatly reduced.

Efficient due diligence tools

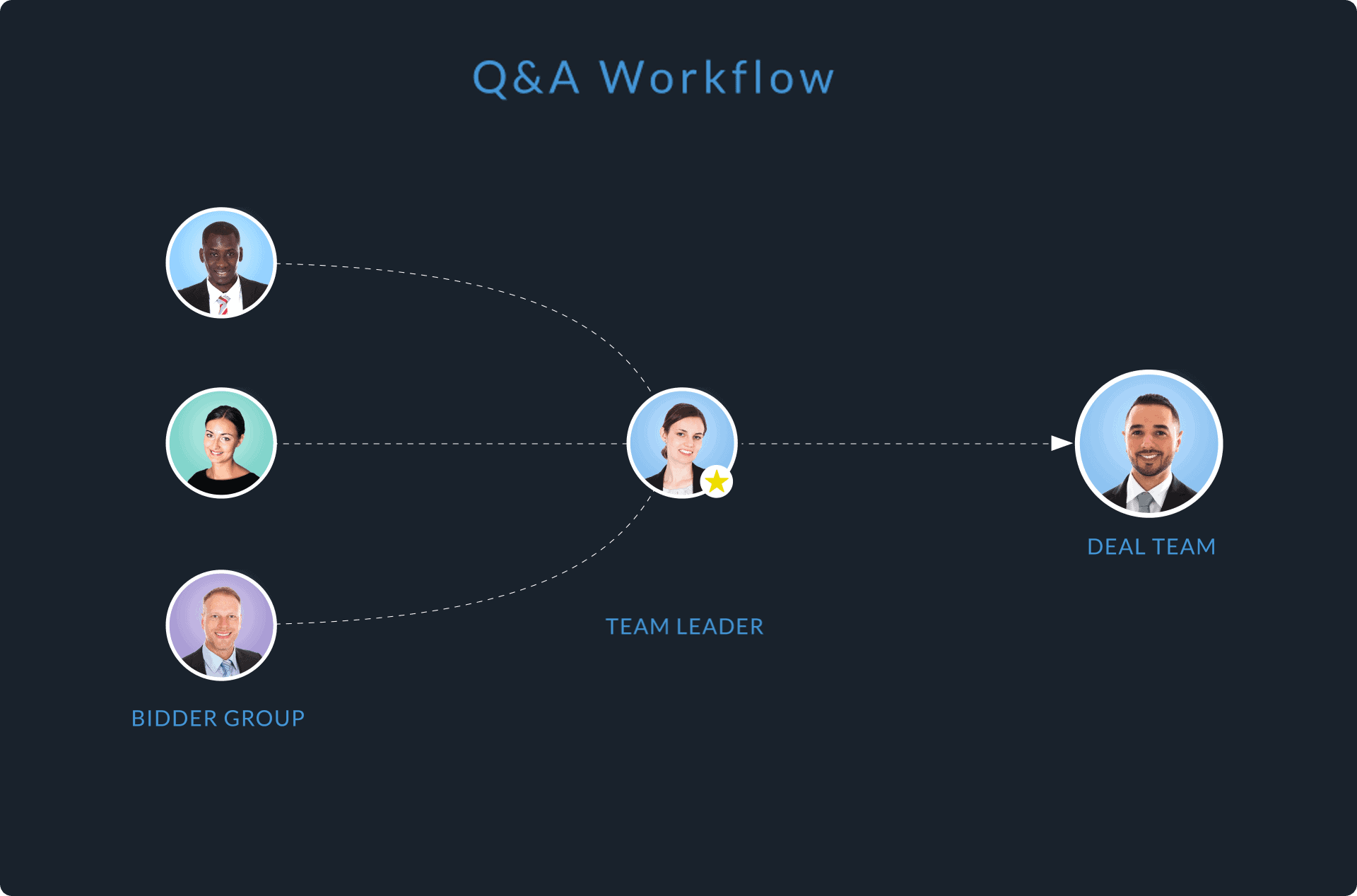

Our sophisticated Q&A tools ensure that questions raised during an M&A process or other transactions are processed and responded to quickly, so as not to impact the closure of your financial services deal. The system also provides a full audit trail of correspondence, to ensure all due diligence has been undertaken and recorded for compliance and regulation purposes.

Imprima VDR Features

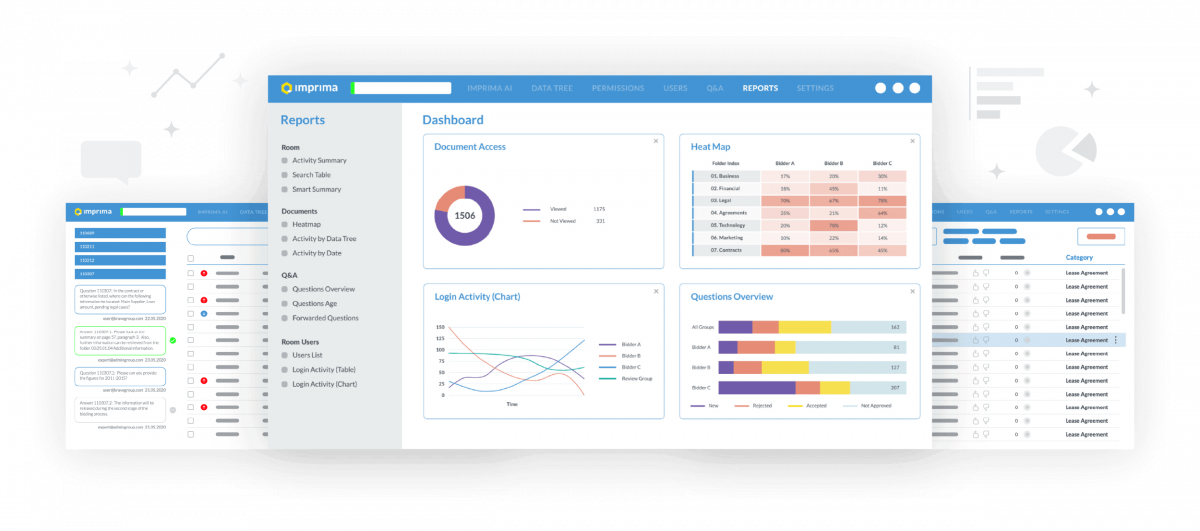

Advanced Q&A

Fast & efficient collaboration in a single secure Q&A environment

Real-Time Reporting

Speed up your analysis and quickly assess what bidders are interested in

Powerful AI Tools

AI-powered VDR Index, Contract Review and Contract Summaries

Automated Redaction

Automatically protect confidential information to comply with latest regulations

Granular Permissions

Control your documents on a group or user level, down to document level

User Access Control

Granular permissions on users' data access & full document protection

VDR Branding

Market your firm with a branded VDR while marketing your real estate portfolio

Pre-VDR Services

We help you source, structure, and corroborate all your data and archives

API

Manage, download & upload documents straight from your CRM system to your VDR

Full Audit Trail

100% auditable trail for compliance on all user and administrator actions

Bulk Actions

Asset managers can perform large scale changes quickly

Secure Excel Viewer

Access MS Excel documents online through a native-like experience

It’s a very easy platform that allows the control of information by both parties and has a very easy Q&A process that is important in a Due Diligence Stage.

Your security credentials and track-record gave us the peace of mind that our information was safe and the system was always available, meaning we did not have to worry about delays on the deal.

The excellent data room service was essential to our successful transaction. We will definitely select Imprima as our data room provider in the future.

We really appreciate your flexibility and high-quality service throughout the transaction, especially your quick responses and turnarounds to our requests.

The Imprima VDR platform was always quick and reliable for us and our clients. The team’s ‘hands on’ and client-oriented approach allowed us to lean on them throughout the entire project. The Imprima Service Team responded quickly and precisely at all times and we at Unicredit really appreciated this.”

We used Imprima’s virtual data room service for a privatisation process over a period of almost 12 months. The system was easy to use and we didn’t need any special training to set it up. The management of the documents, the access levels and the questions sent to us from the bidders electronically was straightforward.

Customer Success Stories

Some of the financial services deals hosted on Imprima Virtual Data Room

- Financial Services

MACSF strengthens its position as the leading insurer for healthcare professionals. Following two years of private negotiations, the mutual insurance group has signed a deal to acquire the life insurance business of Groupe Pasteur Mutualité, GPM Assurances. Imprima’s Data Room platform was used for the deal.

- Financial Services

Cinerius Financial Partners (Cinerius or the Cinerius Group), a portfolio company of Summit Partners (Summit), has received a majority investment from IK Partners (IK) alongside significant reinvestment from Summit, the management team, and other shareholders. Imprima VDR was used to facilitate the transaction.

- Financial Services

Optio acquires leading European film and events MGA the Circles Group. Imprima was used for the transaction.

Ready to get started?

Contact us to find out more about our VDR solution for financial services.

FAQ

Yes. Our bespoke securitisation data rooms ensure you can carry out heavily regulated transactions in the most secure, reliable environment available. We have extensive experience with the intricacies of asset-backed securities (ABS) including mortgage-backed securities (MBS, CMOs), both commercial and residential (CMBS, RMBS). Imprima VDR enables disclosure requirements relating to structured finance instruments in compliance with the regulations of National Banks, including the US SEC rule 17g-5 and Bank of England regulations.

Key clients of Imprima’s Virtual Data Rooms for Financial Services include Lloyds Banking Group, BBG, Nationwide, Coventry Building Society.