Virtual data room software is used by various businesses and organisations in a range of different situations. Since being first introduced to the market a few decades ago, it has permanently replaced traditional data storage and sharing solutions as companies quickly came to see the benefits it brings. This post will explore what the software is and why it was only a matter of time for it to replace traditional solutions.

What is virtual data room software?

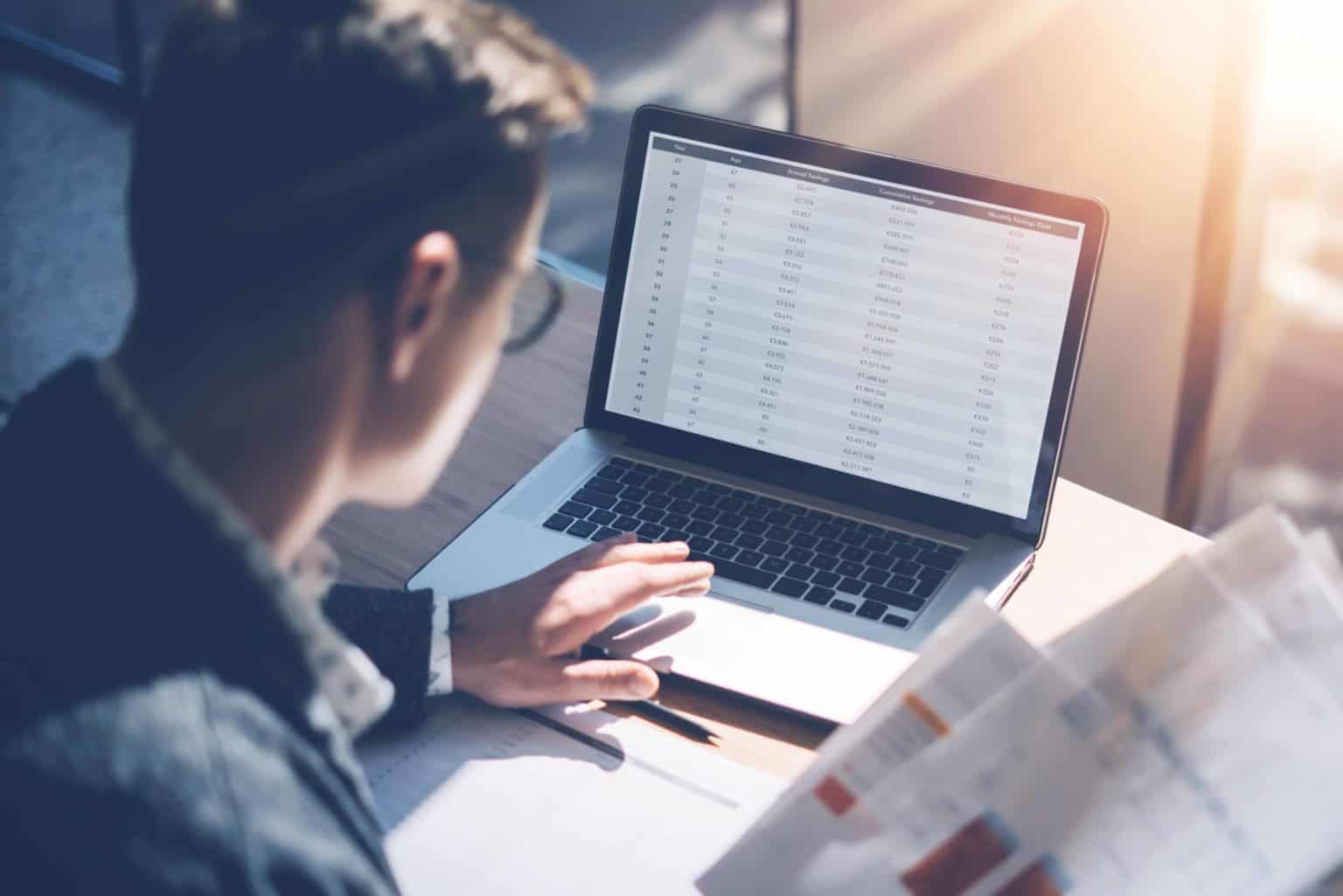

Virtual data room software provides organisations with a secure online space in which they can store their documentation. It is often referred to as VDR and, sometimes, as an electronic data room.

VDR eliminates the need for physical data storage systems. They are a convenient solution, capable of providing access to unlimited parties at any time.

What are the uses for virtual data room software?

Its primary purpose is to provide businesses and organisations with a controlled environment to share critical information with other interested parties. This could be either people inside the organisation, such as staff or leadership, or outside the organisation, such as clients and investors.

VDR software is most often used during mergers and acquisitions transactions. The software acts as a data repository and a secure collaboration space for divisions or companies being sold or acquired

What are the benefits of virtual data rooms?

Being Incredibly secure is one benefit, which enhances an organisation’s due diligence processes. This is likely one of the main reasons they are used – because they are an efficient and safe method for storing and sharing sensitive and confidential data between people within an organisation or multiple organisations. Because this is a universal need, VDRs are ideal for many industries and situations.

Because the software eliminates the need for physical paperwork in many cases, it has reduced clutter and waste. Digital data storage solutions like this have helped organisations downsize because there is a reduced need for physical space to store critical data. This has brought the additional benefit of reducing overheads.

Are virtual data rooms secure?

The answer is YES; they are incredibly secure because they are designed with the highest level of security in mind. Providers invest heavily in multi-faceted, comprehensive security processes to ensure their clients’ data is protected with the highest security levels.

The technology behind virtual data rooms incorporates multiple, complex layers, ensuring an all-encompassing barrier that protects against possible threats and risks.

In conclusion, virtual data rooms are a reliable, efficient, and cost-effective method for companies to store and share critical data with interested parties. Features and tools vary between providers, so organisations should compare options to ensure their chosen solution meets their individual needs.